espp tax calculator california

1700 2000 300 Number of shares. An ESPP is a type of stock plan that lets you use after-tax payroll deductions to acquire shares of your companys stock.

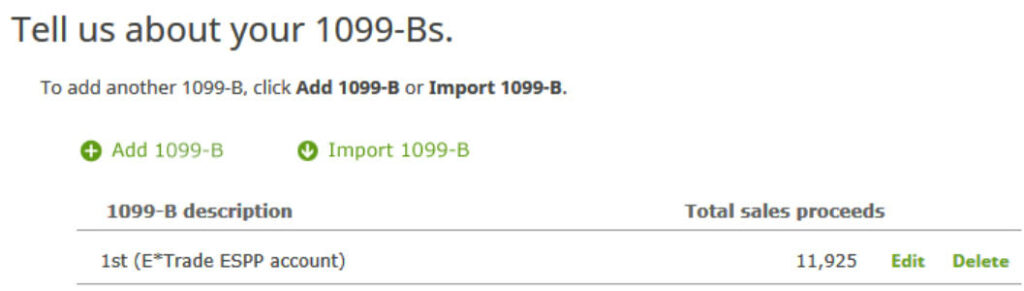

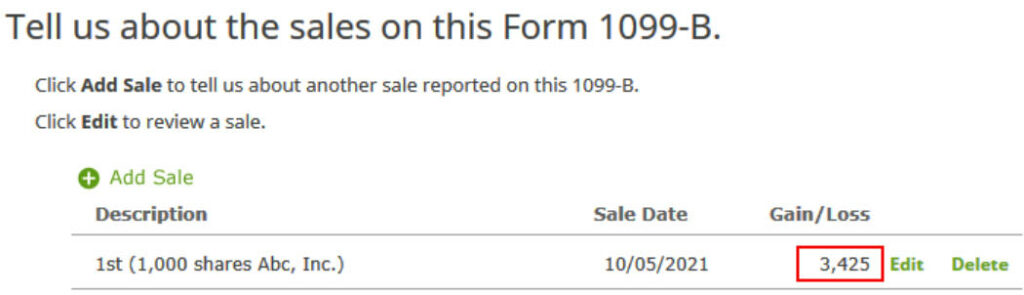

How To Do 2021 Espp Sale In H R Block Don T Pay Tax Twice

The discount offered based on the offering date price or.

. The cookie is used to store the user consent. Using the ESPP Tax and Return Calculator. Espp tax calculator california Sunday February 20 2022 Edit.

An ESPP or Employee Stock Purchase Plan is an employer perk that allows employees to purchase a companys stock at. The majority of publicly. If you make 55000 a year living in the region of California USA you will be taxed 11676.

The gain calculated using the actual purchase price and. This cookie is set by GDPR Cookie Consent plugin. This calculator assumes that your purchase price is calculated picking the lower stock price between the purchase date and the first date of the subscription.

An employee stock purchase plan ESPP is a company-run program in which participating employees can purchase company stock at a discounted price. When you buy stock under an employee stock purchase plan ESPP the income isnt taxable at the time you buy it. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

You can use investment capital losses to offset gains. In most cases the discount you received will be reported as ordinary income in. ESPP Basis current About.

Your household income location filing status and number of personal exemptions. Employee Stock Purchase Plan ESPP Calculator. ESPP Discount of 15.

Price shares are finally sold. Financial Managerial Accounting for MBAs 6e by. Navigating the performance and tax implications of your employee stock purchase plan can be overwhelming.

Employee stock purchase plans. That means that your net pay will be 43324 per year or 3610 per month. California will tax the wage income to the extent services were performed in California from the grant date to the vesting date.

Again you are in the 24 tax bracket and. Youll recognize the income and pay tax on it when you sell the stock. To maximize the opportunity of ESPP participation you must understand the tax impact.

The ESPP tax rules require you to pay ordinary income tax on the lesser of. Espp tax calculator california Monday February 21 2022 Edit. Possible other state tax credit.

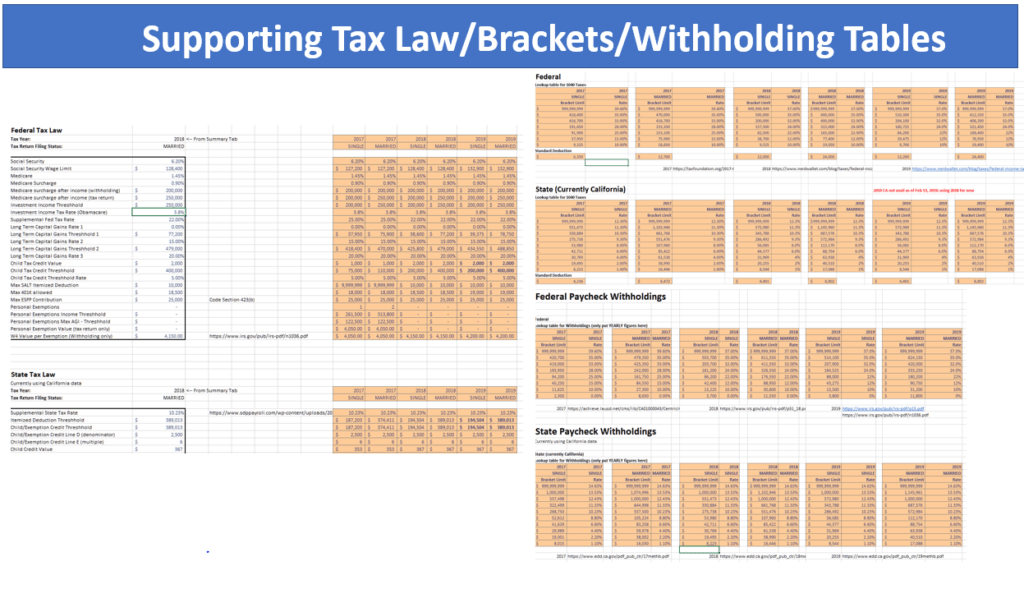

See the prior article in the ESPPs 101 series for an explanation of the. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The California State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 California State Tax CalculatorWe also.

Your employer withholds a 62 Social Security tax and a.

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

How To Do 2021 Espp Sale In H R Block Don T Pay Tax Twice

6 Big Tax Return Errors To Avoid With Employee Stock Purchase Plans

Employee Stock Purchase Plan Espp The 5 Things You Need To Know

Changes To Accounting For Employee Share Based Payment The Cpa Journal

How Are Rsu S Of Public Technology Companies In California Taxed Quora

Should I Even Bother Contributing To My Company S Espp Rivermark Wealth Management Certified Financial Planner

Introduction To Employee Stock Purchase Plans Espp

Employee Stock Purchase Plans Espps Taxes Youtube

If You Make 150k Per Year In California What Percent Of That Money Goes To Taxes Quora

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Sold My Espp Shares Nice Profit More Tax Owed

6 Big Tax Return Errors To Avoid With Employee Stock Purchase Plans

How To Avoid Getting Double Taxed On Employee Stock Purchase Plan